Group Nduom is contesting the reasons given by the Bank of Ghana to revoke the license of GN Savings and Loans Limited.

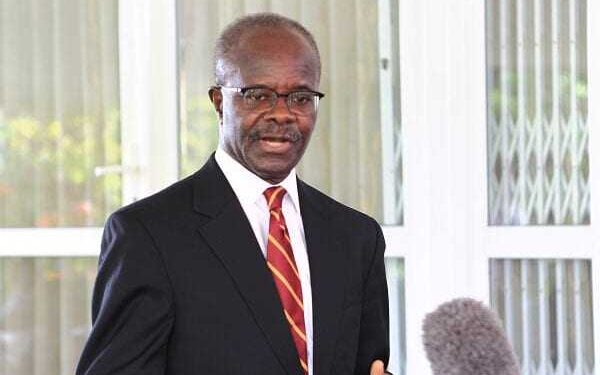

This comes at a time when the Director of Communications of the Bank of Ghana Bernard Otabil had dismissed claims by the Chairman of Group Nduom Dr Papa Kwasi Nduom that the central bank was influenced by former Finance Minister Ken Ofori-Atta to collapse the GN Savings and Loans.

Mr Otabil stated that GN Saving and Loans violated the financial regulations including the Foreign Exchange Act of 2006 (Act 723).

“At the end of the day, it is not in the interest of the central bank or we don’t go out there and say this institution must actually be closed down at all cost. It depends on how the institution is run, it depends on what the institution itself has stated that it wants to do and on respecting the prudential norms. In fact, let me make it clear that the GN Bank and GN Savings and Loans were actually disrespectful to the central bank.

“For instance, if you go through the books you will see that there was a transfer of dollars, and pounds and Euros to International Business Solutions which is an institution affiliated to the group network based outside which was in direct breach of the Foreign Exchange Act of 2006 (Act 723). These provisions are there.

“Our statement of August 16 2019, we stand by that statement and in that statement, we have given all the reasons behind the revocation of the license of GN Savings and loans,” he told TV3’s Paa Kwasi Asare.

But in a statement, Group Nduom said it did GN Bank illegally transfer $62 million to a related company in the USA.

“ The company involved International Business Solutions (IBS) was started by Dr. Nduom in the 1980s. Its objects included business advisory services, procurement of business equipment, sale of computers, printers, communications, and representation of American manufacturers among others. An IBS company was also established in Ghana. Generators, computers, air conditioning equipment, vehicles, raw materials for Groupe Nduom companies have been imported through IBS and paid for by the relevant companies. Non-Groupe Nduom companies have also bought imported equipment and supplies from IBS and paid for them. This has gone on legally with appropriate documentation since the 1980s. The idea that over $60 Million in foreign currency transactions can occur over a 10-year period with “no documentation” as implied by Bank of Ghana in that release is extremely far-fetched.|

Below is the full statement from Group Nduom…

PRESS RELEASE

BANK OF GHANA’S AUGUST 16, 2019 STATEMENTS ARE WILDLY INACCURATE; THE GN SAVINGS LICENSE MUST BE RESTORED & UPGRADED

The statements Bank of Ghana (BOG) issued on August 16, 2019 regarding GN Savings are wildly inaccurate; BOG was aware that GN Savings had available to it more than the GHS30.33 million that it relied upon to declare it insolvent; GN Savings was not allowed by regulation and GN Bank did not engage in illegal foreign currency transfers; GN Savings complied with all requirements laid down by BOG as a savings and loans company and wrote a detailed report in June 2019 to prove that its business was moving positively forward. These facts are indisputable. BOG made a mistake that it must admit to and correct. Today, the Government of Ghana, its agencies and contractors owe Groupe Nduom companies over GHS7.1 billion. With this money, customers will be paid and GN Savings will have enough capital to become a universal bank once again.

Introduction

On August 16, 2019, Groupe Nduom issued the following press release: “It has come to the attention of Groupe Nduom Limited, the entity representing the interests of the majority shareholders and founders of GN Savings Limited, that documents are circulating that purport to be from the Bank of Ghana (BoG) regarding the receivership of GN Savings Limited.

Please note the following:

1.1. Neither shareholders nor management of GN Savings have received any official communication from the BoG regarding receivership.

1.2. If these documents are indeed genuine, the statements within regarding GN Savings are wildly inaccurate. Given the detailed information provided to the BoG nearly a year ago, these statements are inconsistent with our discussions with both the BoG and the Ministry of Finance (MoF). We are aware that the MoF has previously confirmed that balances due to GN Savings and other related parties are far in excess of the amounts quoted in the communication from the BoG.

1.3. Our position is that GN Savings is not only solvent but would be highly liquid if the MoF simply ordered itself and other government agencies to quickly pay amounts owed to GN Savings and other related entities. We expect this matter to be resolved in due course.

1.4. GN Savings and all other concerned stakeholders will respond with more detail shortly, but in the meantime, we pray that all customers and stakeholders remain calm while we work through this matter with the relevant stakeholders.”

We pursued the opportunity to get the matter resolved in an objective manner by petitioning President Nana Akufo-Addo, Vice President Mahamudu Bawumia, House of Chiefs, religious leaders and many others including the Governor of the Bank of Ghana. Many meetings were held prior to the revocation with the former Minister for Finance Ken Ofori-Atta and the former Minister of State at the Ministry of Finance Charles Adu Boahen. Upon advice from a key member of the current administration, we went to court to seek justice and get the license restored.

We wish to point out to the public that there are important distinctions between GN Bank and GN Savings and Loans (GN Savings). Everything important that has been put in the public domain by one Bernard Otabil, the BOG Director of Communications; and the recent rehashing of the BOG’s August 16, 2019 release make it necessary to advice readers to be discerning and not to confuse to GN Savings for GN Bank. BOG cannot use alleged issues associated with GN Bank to justify its deliberate and revocation of the GN Savings license.

It is a fact that all the allegations being rehashed against GN Bank had been reviewed by the Governor of BOG before GN Bank was reclassified to become GN Savings. The question is what changed to cause the revocation.

GN Bank

In 1997, we set out to invest and develop “the People’s Bank”. After nine years of planning, preparation, and interactions with the Bank of Ghana, First National Savings & Loans Company Limited was granted a license to open for business in May 2006. Our company, Coconut Grove Hotels was the major shareholder, later to be joined by others. These included a George Soros organization. By 2012, First National was operating in over 50 branches and was profitable as confirmed in its audited financial statements. In 2014, it obtained a universal banking license from the Bank of Ghana and became GN Bank. This means that the requirements for a universal bank had been met.

It is instructive to know that BOG commissioned a ‘’Diagnostic Studies into the Valuation of Loans and Investments of Banks in Ghana’’. It was an exercise undertaken by the Banking Supervision Department where specific reports were issued in relation to the performance of each banking entity in the country.

According to the BOG letter dated-9th March, 2016 the Central Bank undertook the ‘’special exercise to assess the quality of the financial exposures in the form of loans and advances as well as investments in the banking system as at 31st May, 2015 and later updated to 31st October 2015. The Auditing Firm, Ernst & Young was engaged to undertake the assignment in your bank’’.

Our checks at the BoG confirm that the end of the exercise, GN Bank was given clean financial health bill to continue with its operations in the banking and the financial sectors of the country.

In the case of GN Bank, the letter stated explicitly: ‘’At the end of the exercise your bank was assessed to hold adequate provision to your financial exposures. You are advised however to continue monitoring of your loans and investments portfolios to ensure that the quality does not deteriorate and to book appropriate provision when necessary’’. The directors of the bank advised management to take this seriously and guard the reputation of the bank.

By December 31, 2018, management had developed 305 branches with 297 formally opened.

How much money is owed by government and its agencies to GN Companies?

On August 7, 2019, Mr. Charles Adu Boahen the former Minister of State at the Ministry of Finance wrote a letter alleging that government and its agencies owed only GHS30,329,483.84 to Groupe Nduom companies. Dr, Papa Kwesi Nduom responded on Aughst 9th as follows: “…wish to acknowledge receipt of your letter dated 7 August 2019 on the above-stated subject. The total figure quoted, GHS30,329,483.84 is unknown to us. We do not know which contracts or contractors are included in that figure. We have presented a much higher value of Certificates for your consideration.” It is this figure that was used by the BOG to determine that GN Savings was insolvent. We believe that this was orchestrated between the Ministry of Finance and Bank of Ghana officials. This is because the Minister for Finance in August 2018 wrote to the Governor of the Bank of Ghana to confirm a figure, they had determined to be more than GHS640 million and counting. Even more important, the Ministry of Finance caused an independent audit of the Groupe Nduom infrastructure portfolio to be performed by an accounting firm. This resulted in a figure of more than GHS1.8 billion. It is this figure that has grown with interest to be more than GHS7.1 billion (due from COCOBOD, GETFund. Road Fund, Ministry of Works and Housing, Ministry of Roads and Highways and Ministry of Finance. A demand letter has been sent to the Ministry of Finance with copies to the President, Vice President, Attorney General, Chief of Staff and the agencies involved, with no responses received. Groupe Nduom has filed various lawsuits on the debts owed.

Finally, it is important to note that on August 6, 2019, BOG wrote to the management of GN Bank to assign more interim payment certificates (IPCs) worth hundreds of millions of cedis to the Central Bank. Why did it turn around in a few days to trumpet GHS30.33 million as the only funds available to the bank?