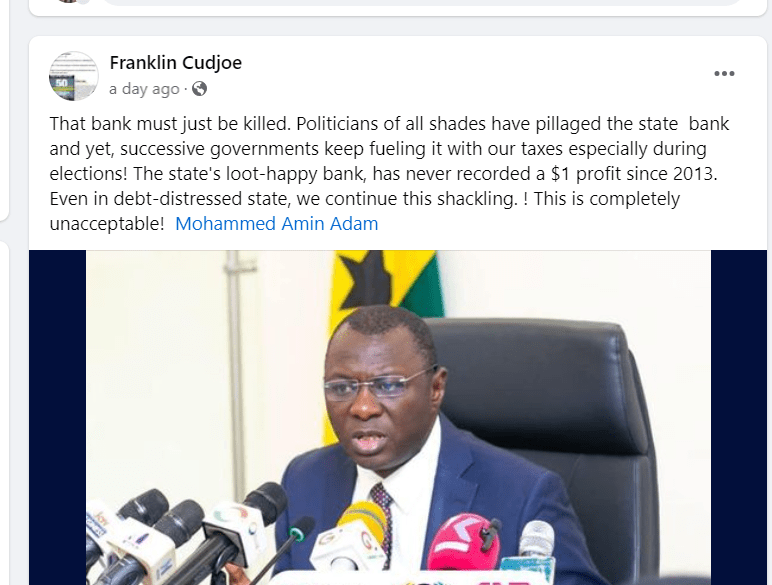

Founding President of IMANI Africa, Franklyn Cudjoe, has said that the National Investment Bank should just be collapsed.

He is against any move by the government to inject capital into a bank that has not made even a one-dollar profit since 2013.

In a post on his Facebook page, Mr Cudjoe said “That bank must just be killed. Politicians of all shades have pillaged the state bank and yet, successive governments keep fueling it with our taxes, especially during elections! The state’s loot-happy bank, has never recorded a $1 profit since 2013. Even in debt-distressed state, we continue this shackling. ! This is completely unacceptable!”

His comments come at a time when the Minister of Finance Dr Mohammed Amin Adam has assured that the Ministry and the Bank of Ghana (BoG) would soon implement a plan to resolve the challenges of the NIB.

He described the plan as credible, comprehensive, and cost-effective.

NIB is experiencing turbulent years of banking following a switch from its primary duties as bank for local industries to a universal Bank; focusing on development and commercial banking activities.

Established through an act of parliament and regulated by the Bank of Ghana, the NIB bank currently has over 70% of the Bank’s portfolio made up of loans to the Ghanaian private sector.

With the current economic challenges and banking crisis, analysts suggest the bank’s Non-Performing Loans (NPLs) to both government and the private sector could be higher and negatively affect its books.

But the Finance Minister said during his monthly economic update in Accra on Friday May 24 that “The Bank of Ghana and the Minister of Finance have designed and would soon begin the implementation of a credible, comprehensive and cost-effective plan that seeks to address NIB’s challenges.”

Dr Amin Adam further said that the cabinet has approved a plan for the restructuring and recapitalisation of the National Investment Bank (NIB).

Amin Adam said, “As part of the implementation of the PCPEG, the cabinet has approved the plan for restructuring and recapitalisation of the National Investment Bank (NIB). This will require an injection of about GHC2.3 billion and this will be done over the next 12 months.”

“The first tranche of GHC400 million is expected to be transferred to the National Investment Bank before the end of this month. This demonstrates our commitment to implementing the recapitalisation and restructuring programme of NIB. The plan also includes measures to strengthen the governance structure. The government has intervened in NIB in the past and so this time around, the capital intervention is going to be backed by governance reforms in NIB in order to assure us and the people of Ghana to their money that would be put into NIB would be managed well.”