President Nana Addo Dankwa Akufo-Addo has highlighted the benefits of interoperability, the ability to operate in conjunction with each other, on the African continent.

Among other things, he said interoperability reduces delays in transacting businesses.

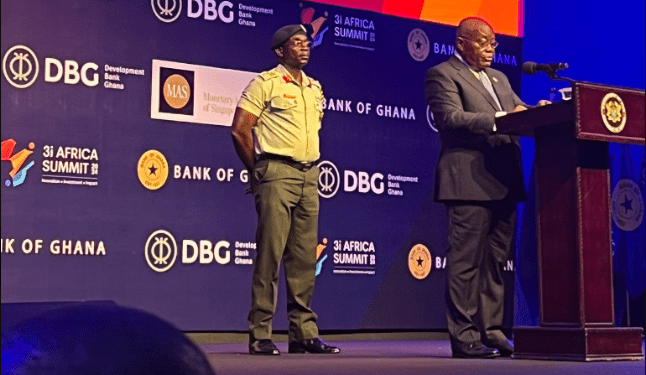

“We must create interoperability across Africa to facilitate everyday buying and selling among millions of Africans across borders,” he said during the opening of the 3i Africa Summit in Accra on Monday, May 13.

He said “We must promote interoperability, and reduce the transaction cost of delays, tearing down the [cycle] that has hindered our progress for too long. We must leverage the power of digital identity programmes such as the Ghana Card to improve access to financial services, reduce fraud and create a more inclusive and equitable economic system.

“Ghana has emerged as a good example of what is possible in embracing digital transformation. Our initiatives such as the Ghana Card, the Ghana.gov portal and mobile money interoperability have reshaped the landscape of public service delivery and expanded financial inclusion. Today some 17 million of our folks now possess a digital ID.”

For his part, Finance Minister Dr Mohammed Amin Adam said that the success of financial innovations rests on a strong financial services sector that operates in a stable macroeconomic environment.

To this end, he said, the government of President Nana Addo Dankwa Akufo-Addo is unrelenting in creating an enabling macroeconomic environment to support economic growth.

“For this reason, Ghana’s economic rebound has been quite swift with economic growth ending the year 2023 at 2.9% against a target of 1.5%, inflation heading towards the year-end target of 15%, and interest rates declining. Despite recent pressures on our currency, the cedi’s depreciation year-to-date of 12% is far lower than its depreciation of 27% in the same period last year,” he said at the same event.

He further stated that the Government is implementing measures on the fiscal side including acceleration of disbursements of almost $1 billion by the development partners between now and December this year to support the economy.

“As we convene at the 3i Africa Summit in Ghana, it is incumbent on us to acknowledge the remarkable strides that Ghana has made in nurturing a vibrant fintech ecosystem. Ghana’s fintech sector boasts of a diverse array of startups, accelerators and regulatory initiatives, solidifying our position as a frontrunner in fintech innovation across the continent.

“I commend the Bank of Ghana for being proactive in establishing a regulatory framework conducive to fintech innovation, exemplified by initiatives such as the Payment Systems and Services Act, Act 987 and establishing a Fintech and Innovation Office. These efforts affirm our commitment to fostering innovation while safeguarding consumer interests and preserving financial stability.

“I want to take this opportunity also to acknowledge the many incubators across Ghana, including the Ghana Tech Lab and MEST Africa, that provide invaluable support to fintech entrepreneurs through mentorship, financial backing, and networking opportunities.”

The 3i Africa Summit has brought together key players in the financial, investment, policy-regulatory and digital technology domains in Africa. These include 3 Heads of State, 10 Governors of Central Banks within and outside Africa including the Bank of Ghana’s Dr. Ernest Addison, the Central Bank of Nigeria’s Dr. Olayemi Michael Cardoso and the National Bank of Rwanda’s Hon. John Rwangombwa.

In addition, there are over 150 Chief Executives and Senior Executives of FinTechs and Financial institutions across the globe including Serigne Dioum, CEO of MTN Group Fintech, Dr. Patrich Saidu Contech, CEO of Africa Fintech Network, Saurav Bhattacharya, CEO of Proxtera, Conrad Kraft, Strategic Advisor, DigitalEuro Association, and Co-Founder and CFO, Tradelite Solutions, Mariame MacIntosh Robinson, President of Qenta Inc., Sopnendu Mohanty, Chief Fintech Officer at MAS.