In the wake of the poor performance of the Cedi against the Dollar, the government will have to prioritise the provision of incentives for businesses to produce more, not the introduction of taxes, Minister of State under the Rawlings administration, Kojo Yankah, has said.

Mr Yankah indicated that taxing businesses amidst the dwindling fortunes of the local currency is only suffocating the business community.

Ghana’s cedi is in a record-breaking weakening cycle. The currency hasn’t gained versus the dollar in the past 22 trading sessions, the longest streak, Bloomberg reported.

The currency hasn’t gained versus the dollar in the past 22 trading sessions, the longest streak according to data compiled by Bloomberg going back to 1994. The cedi traded 0.3% weaker at 13.9310 by 1 p.m. in London. It’s declined 14% this year, a slump beaten only by currencies that have been devalued, including the Egyptian pound and Nigerian naira.

The slide has been fueled by a slump in cocoa earnings, with exports dropping by nearly a third to $508 million in the first two months of the year due to adverse weather, disease and fertilizer shortages.

Despite a temporary surplus in 2023, Ghana’s historical current account deficit is also resurfacing, signaling further challenges to the cedi, said Gergely Urmossy, emerging market strategist at Societe Generale.

The cedi’s forward curve calculation sees the currency breaching its record low of 14.6174 per dollar by the third quarter, ending the year at 15.98. FX forward pricing is calculated based on the spot rate and the interest rate differentials between the two currencies for the tenor of the forward.

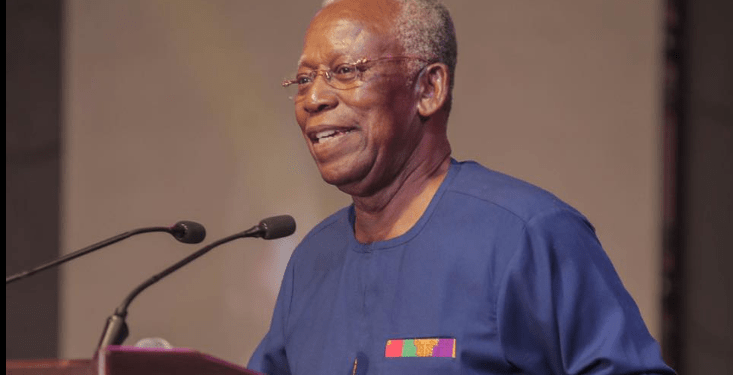

Commenting on this the Founder of the Pan African Heritage Museum and the African University College of Communications (AUCC) said on his Facebook page that “In a situation like below, what should we hear from our leaders ? Incentives for Production and more Production ! Not more levies and taxes ! Suffocating the producer is certainly not the key.”