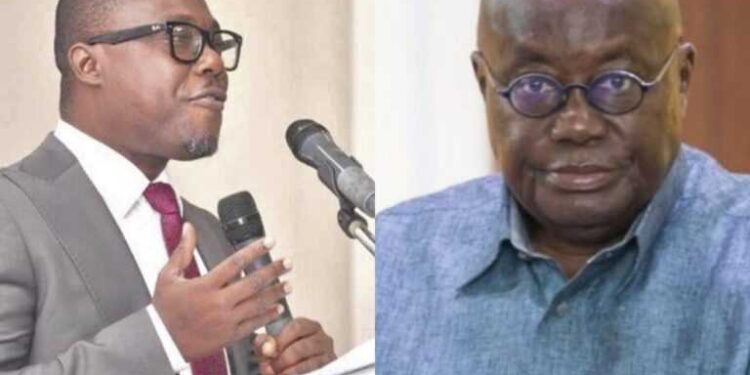

A Professor at the University of Ghana, Ransford Gyampo has said that he associates himself to the calls to the president to release the KPMG audit report on the deal between the Ghana Revenue Authority (GRA) and the Strategic Mobilisation Limited (SML) to the public.

However, he said, the report should be released only on the condition that Ghanaians will read it and have a balanced view of the matter.

“It should be released on condition that we will read. The discussion clearly show that we have not read thoroughly the scanty report release,” he said on the Key Points on TV3 on Saturday, April 27.

He added “let us have a balanced view of it and if there is a clear need for the service let’s make that point, if there’s a need for a review we should talk along that line. It appears the regime is noted for clearing people even before they are investigated and so we are fixated on that posturing and so we don’t see anything.

“if this deal is problematic let us look where those problems are and fine-tune it rather than throwing or talking in a manner that discourages private investors in Ghana who want to invest their money for the proposes of generating employment,” he added.

For his part, lawmaker for Asante Akim North lawmaker Kwame Andy Appiah-Kubi if there is any procurement default in a contract between the state and a private individual the state is to blame for it, not the private investor.

He explained that it is for the state to investigate the proposal of the private investors against what the law says but if they neglect that duty, the problem will not be blamed on the investor.

“I don’t see anything wrong that the company has done, if there is any procurement breach I will blame the GRA not the company.

“If procurement default occurs in a contract I will blame the state, not any contracting party. When the whole machinery of government is available and I am coming as a private investor to engage with you and you want to burden me with your negligence?” He said.

He was contributing to a discussion on the KPMG audit report on the deal between the Ghana Revenue Authority (GRA) and the Strategic Mobilisation Limited (SML).

Mr Appiah-Kubi said the request for the publication of the KPMG audit is right.

If for nothing at all, he said, the publication will help in informed discussions on the matter.

“Whether there was a call or not to publish the report, reports are meant to be served on interested parties, it does not take somebody to call for the releases. If we are interested to know what is there, that is right.

“The call is appropriate, we spent money to produce the report, if for nothing at all for the education. It is important to publish. I am not aware that anybody is trying to shelve it. we must begin to interrogate the report,” he said.

The report issued by accounting and auditing firm, KPMG on the agreement between the GRA and the SML revealed that no technical needs assessment was done prior to the engagement of SML.

However, the report said, such an assessment was not legally required for engaging SML.

In a statement released by the Presidency on Wednesday, April 24, portions of the KPMG report were captured stating that “No technical needs assessment was done prior to the engagement of SML. However, such an assessment was not legally required for engaging SML. After SML was engaged, a Chamber of Bulk Oil Distributors’ industry report, a 2021 Ernst & Young audit report commissioned by GRA and a report by the Revenue Assurance and Compliance Enforcement of the Ministry of Finance all found that there might be underreporting, under-declaration and potential revenue leakages.

“On three occasions (between June 2017 and September 2017), GRA sought approval

from the Public Procurement Authority (“PPA”) to use the single source procurement

method to engage SML to provide transaction audit services. PPA did not grant approval.

Subsequently, GRA engaged SML as a subcontractor to West Blue which was already

providing services to GRA at the port. SML eventually took over the services provided by

West Blue when the latter’s contract came to an end on 31st December, 2018. GRA then

added external price verification to the services offered by SML and signed a downstream

petroleum audit agreement with SML.

“All these were done without PPA approval. Following a change of leadership at GRA, the new leadership sought to regularise the contracts with SML and on 27th August, 2020, PPA ratified the procurement processes used to engage SML. In 2023, the Ministry of Finance (MoF), GRA, and SML entered into a Revenue Assurance Services Contract (“2023 Contract”). The 2023 Contract extended the scope of SML’s services to include upstream petroleum and minerals audit. PPA approval was obtained for this contract, which is now the governing agreement for the services offered by SML to GRA. Another issue raised by KPMG is the absence of parliamentary approval for the contracts, given that they are multi-year contracts. Under section 33 of the Public Financial Management Act, 2016 (Act 921) (“PFMA”), such contracts must have ministerial and parliamentary approval. KPMG also found that there was no evidence that the 2018 and 2019 contracts (transaction audit services, external price verification, and downstream petroleum audits) were submitted to the GRA Board for discussion and approval contrary to the GRA Act, Corporate Governance Manual for Governing Boards/Councils of the Public Services, and sound and accepted corporate governance practices. The GRA Board approved the extension of SML’s services to cover the auditing of the upstream petroleum and minerals sectors, as specified in the 2023 Contract.

“Regarding the transaction audit services, KPMG concluded that SML partially delivered on

the service requirements. However, given the observations made during the investigations, GRA may not have obtained all the expected benefits from the service. This is also partly due to GRA’s lack of instituting monitoring and evaluation processes to

assess the performance of the service and hold its personnel and SML accountable for

non-performance.

“Regarding the external price verification services, KPMG concluded that SML delivered

partially on the service requirements and that, given the observations made during the

investigations, GRA may not have obtained all the expected benefits from the service. It

was noted that ICUMS has inbuilt capabilities of external price verification among other

functions. Regarding the downstream petroleum audit services, KPMG determined that there was an incremental volume of 1.7 billion litres and an incremental tax revenue of GHS 2.45 billion for the period under review.

“There were also qualitative benefits, including a 24/7 electronic real-time monitoring of the outflow and partial monitoring of inflows of petroleum products at depots where SML had installed flowmeters. This serves as a deterrent for under-declarations. Other qualitative benefits include six levels of reconciliation done by SML to prevent revenue losses to GRA and the sharing of discrepancy reports with GRA to follow up.

“SML had yet to implement the upstream petroleum audit and minerals audit services, and therefore, there could be no assessment as to whether GRA would derive value or benefit from that service. KPMG noted, however, that those are areas that could have significant

revenue leakages and, thus, suggested, among other things, that a comprehensive needs

assessment be conducted to establish a need for those services.

The pricing model used in the contracts was based on a variable fee structure. During its

investigation, KPMG noted that such transaction monitoring services are usually priced

using a fixed fee pricing model. The total fees paid under the contracts from 2018 to the date of suspension amount to GH¢1,061,054,778.00. No fee has been paid for the upstream petroleum audit and minerals audit services. The total fees estimated to be paid to SML under the 2023 Contract for five years is GH¢5,173,091,857.00, which averages to about GH¢1 billion per year.”

President Nana Addo Dankwa Akufo-Addo acted on the report presented to him by KPMG on the agreement between the GRA and the SML.

The President has made a number of directives following the reports.

A statement issued by the Presidency on Wednesday, April 24 highlighted the directives saying “The upstream petroleum audit and minerals audit services have not yet been

commenced, and no payments have been made in respect of those services; therefore,

they may be terminated.

However, given that the upstream petroleum audit and minerals audit services could prevent significant revenue leakages, the President has directed that the Ministry and GRA conduct a comprehensive technical needs assessment, value-formoney assessment, and stakeholder engagements before implementing such services.

“The transaction audit and external price verification services may also be terminated.

According to KPMG’s findings, GRA obtained partial value or benefit for those services.

This was also due to a lack of monitoring on the part of GRA to ensure that SML performed

the services as stipulated in the contracts. KPMG’s investigation found that GRA has introduced external price verification tools as part of ICUMS, among its other functions. This renders the reliance on SML for external price verification redundant.

“There is a clear need for the downstream petroleum audit services provided by SML. GRA

and the State have benefited from these services since SML commenced providing them.

There has been an increase in volumes of 1.7 billion litres and an increase in tax revenue

to the State of GHS 2.45 billion. KPMG also observed that there were qualitative benefits,

including a 24/7 electronic real-time monitoring of outflow and partial monitoring of

inflows of petroleum products at depots where SML had installed flowmeters and six

levels of reconciliation done by SML.

This minimises the occurrence of under-declarations. However, it is important to review the contract for downstream petroleum audit services, particularly the fee structure. Given the experience and proficiency of SML over the last four years of providing this service, the President has directed that the fee structure be changed from a variable to a fixed fee structure. Other provisions of the contract worth reviewing include clauses on intellectual property rights, termination, and service delivery expectations.

“SML’s performance in any renegotiated contracts should be monitored and evaluated

periodically to ensure that it meets expectations. Any renegotiated contract should be

compliant with section 33 of the PFMA.”

It added “The Ministry of Finance and the Ghana Revenue Authority are to give effect to the above directives of the President immediately, and provide the Office of the President with an update on the steps taken. The President has extended his sincere gratitude to KPMG for the thorough nature of the audit conducted.”

This matter came uo after a year-long investigation by Evans Aziamor-Mensah, Adwoa Adobea-Owusu and Manasseh Azure Awuni of The Fourth Estate, it was discovered that the company (SML), with the help of a section of Ghana’s media, had made false and unsubstantiated claims of its operations that have served as the basis for the payment it received.

The Fourth Estate asserted that, it appears the Ministry of Finance and the GRA were aware the claims were false, for some officials of the GRA said they had confronted the company about its claims of savings and volumes on two separate occasions.