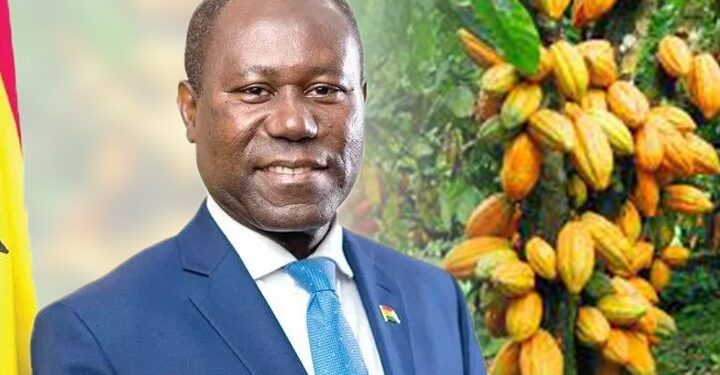

The Chief Executive Officer of the Ghana Cocoa Board (COCOBOD), Joseph Boahen Aidoo, has said the management of COCOBOD has taken several measures to shield the local market from being impacted severely if the prices of the international market collapse.

He said this when he appeared before the Public Accounts Committee (PAC) of Parliament on Tuesday, February 20 to answer questions about the performance of the sector.

He told the Committee that cocoa prices are currently doing well on the international market hence Ghana is going to soon experience a better picture of its local market but in case the prices drop, measures including cutting operational costs, have been taken to deal with the effect.

He explained to the committee that the cocoa sector in Ghana performed poorly between the period 2017 and 2020 because the prices on the world market had collapsed by 30 percent.

Although production went up in 2020, the prices were not the best on the international market, a situation that affected the local market as well, he added.

The International Monetary Fund (IMF) recently said that the state-owned entity mandated with facilitating cocoa production and exercising export monopoly—has long registered losses due to the absence of a systematic mechanism for setting producer purchase price (PPP), significant quasi-fiscal activities (roads construction and input subsidy programs), and large administrative costs.

The debt accumulated by COCOBOD over the past few years became too expensive to service and had to be restructured.

Appearing before the Public Accounts Committee (PAC) of Parliament on Tuesday February 20, Mr Jospeh Boahen Aidoo said “Mr Chairman we are on the path of a turnaround. COCOCOB’s financial situation is dictated by the international market price, that is the word cocoa price. and we all know that from 2017 to the date in question prices of cocoa in the world market had collapsed by 30 percent.

“In 2020 that is also when we had our highest reduction, so when prices collapsed at the time when we had increased yield, definitely, your direct course and inventory go up whereas the revenue generated goes down. That is what explains the huge e deficit for that period. essentially, yes we had record production but prices at the international market did not favour us. ”

Assuming the prices on the world market keep falling, what are you going to do to break even as a company? he was asked by the chair of the PAC James Klutse Avedzi.

In answer, he said “For the past years what we have been doing is taking measures to cut down the cost of operations and other activities. But currently, as we speak the market is going bullish, cocoa prices have relished, there is an ever record so we strongly believe that in the coming years, we are going to see a better picture. It’s bullish, it is not something that is going to ease too soon because the fundamentals are going to keep the prices there for the next three years.”